Understanding Bitcoin ETF and buying options

Cryptocurrencies, with their intricacies and volatility, have remained somewhat elusive for everyday investors. However, the anticipated approval of a spot bitcoin ETF by the U.S. Securities and Exchange Commission (SEC) represents a potential game-changer. This approval heralds a significant milestone in making the crypto market accessible to the broader public, paving the way for an easier and more regulated pathway into the realm of digital assets.

The concept of an exchange-traded fund (ETF) is not new, but its application to cryptocurrencies could revolutionize their accessibility. ETFs, being baskets of assets that trade on stock exchanges, offer investors diversified exposure within a single investment vehicle. The spot bitcoin ETF would specifically hold the underlying assets, providing investors fractional ownership of a pooled bitcoin reserve. This distinction from futures-based ETFs presents a tangible and more direct method for retail investors to participate in the crypto market.

One of the primary advantages of ETFs lies in their intraday tradability, allowing investors to buy and sell shares throughout the trading day. This flexibility aligns with the dynamic nature of cryptocurrency markets, offering retail investors the freedom to capitalize on market movements as they occur. Additionally, the potential approval of a spot bitcoin ETF introduces the prospect of heightened market liquidity, potentially stabilizing the often turbulent crypto markets.

Access to these spot bitcoin ETFs is expected to be predominantly through brokerage services. Platforms like Robinhood, Charles Schwab, Fidelity Investments, and others are gearing up to provide swift access to these new investment opportunities as soon as they hit the exchanges. This anticipated ease of access signifies a significant departure from the complexities often associated with investing in cryptocurrencies through dedicated digital asset platforms.

While cryptocurrency veterans might have previously relied on platforms like Coinbase, the current SEC scrutiny on these platforms limits their ability to handle securities. This regulatory environment has directed investors, especially those new to the crypto space, towards traditional financial channels. Brokerage firms are poised to offer a seamless transition, leveraging their established infrastructure and compliance with regulatory standards to facilitate ETF transactions.

The potential of a bitcoin-focused ETF, while mirroring the volatility of its underlying asset, also opens doors to the possibility of expanding into a broader spectrum of crypto assets. This evolution could result in a diverse range of crypto ETFs, allowing investors to gain exposure to multiple cryptocurrencies within a single investment vehicle. Such diversity could offer a more balanced and less risk-prone approach for investors navigating the crypto landscape.

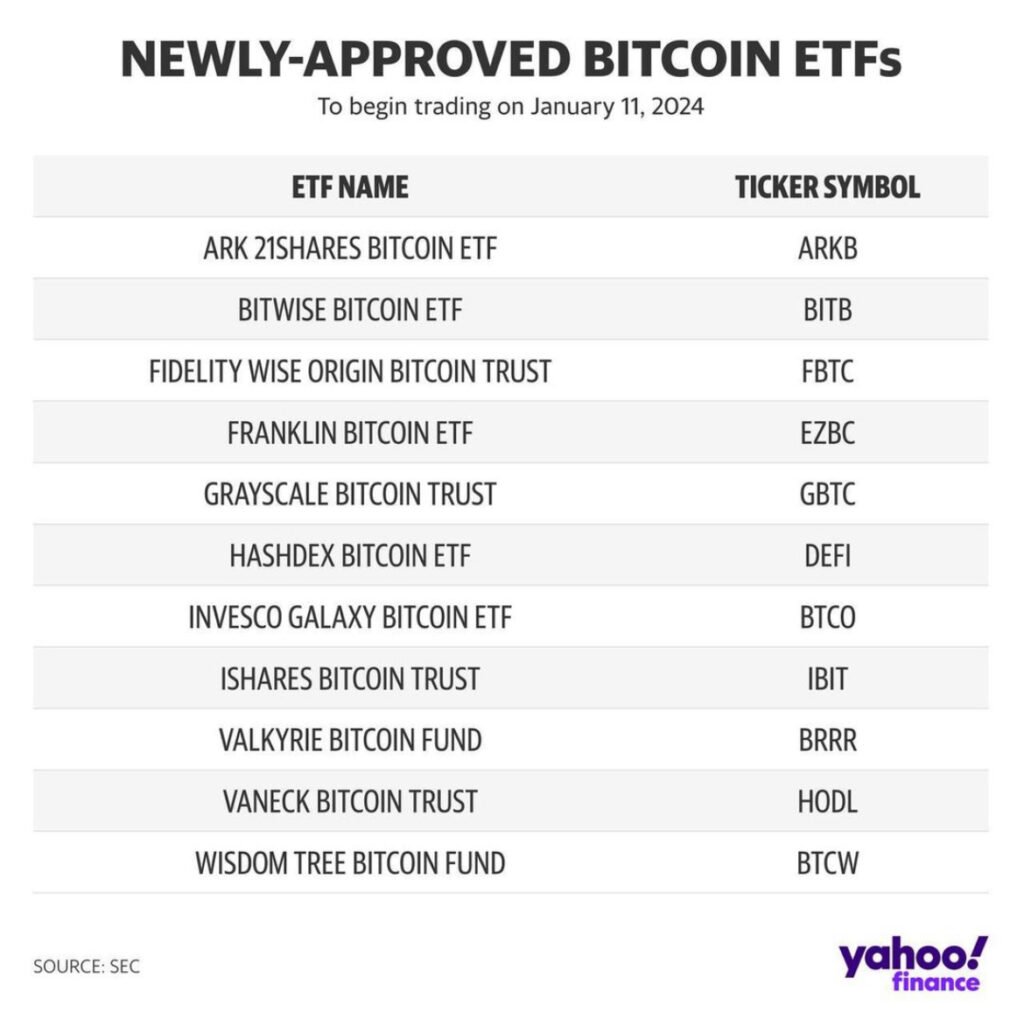

The interest in spot bitcoin ETFs has attracted submissions from notable entities like Fidelity, BlackRock, and Grayscale, among others. The competitive surge among these firms has not only intensified the anticipation but also led to proactive measures such as anticipated fee reductions. Investors may soon witness an array of low-cost ETF options, enhancing their choices in the evolving crypto investment landscape.

In summary, the potential approval of spot bitcoin ETFs signifies a shift towards democratizing access to the crypto market. These ETFs promise an easier, more regulated, and accessible entry point for retail investors, marking a pivotal moment in the evolution of crypto investing.

Expanding on the various facets of ETFs, their implications for investors, the competitive landscape among entities seeking SEC approval, and the broader market implications can provide a more comprehensive view of the potential impact of spot bitcoin ETFs on the cryptocurrency industry.

Here is Robinhood link to sign up to buy Bitcoin ETF (Get free stock on sign up, if you are in US and not a previous user of Robinhood). Conditions apply.

Update- Bitcoin ETF has been approved on 01/10/2024 by US SEC.